Weapons of Mass Production: Fashion and Tariffs

Will the new tariffs force us to be more conscious consumers?

Im sure many of use are familiar with the idea of trade tariffs - I’ve even applied this policy to my everyday life.

When I drive my little cousins to McDonalds, they know they have to pay an import fee - An even handful of fries is pulled from each box before the french fries make their journey from the drivers seat to the back seat.

There are a few things I see shifting in the fashion industry as a result of the tariffs against Mexico, Canada and China. As a fashion obsessed, self proclaimed shopaholic, I can't help but think about the impacts of the tariffs on fashion.

Let’s Digest!

1 - Will the Essence of SSENSE Last? Is Fast Fashion Out as Fast as It Was In?

The tariffs could challenge the fashion industry's current norms, pushing brands to rethink their production and pricing strategies.

In the world of economics production practices are bundled as options of Good, Fast or Cheap. Only two of these things can co-exist successfully but you will always trade off the third. Something can be produced fast and good- but it wont be cheap, it can be made cheap and good - but it wont be fast, it can be made cheap and fast- but it surely wont be good.

Outsourcing labor restructured the definition of cheap and fast, as those are relative terms. If something is produced in China it can be made faster and cheaper than previous domestic production.

The global apparel market is projected to hit $1.9 trillion by 2025, with fast fashion accounting for a significant chunk of that. But tariffs could upend this model by increasing the cost of goods imported from key manufacturing hubs.

Fast fashion, which thrives on quick and cheap production, might struggle to maintain its model as costs rise. The internet acts as the fast paced environment that leads fashion and many of its trends. The speed of the internet requires brands to work fast to stay on trend and avoid irrelevancy. As a culture micro trends become more prominent when it is easier for clothes to be produced as a reaction to the trends. As it becomes more costly to produce in countries that are historically “Fast and Cheap” it will become harder for fashion to stay up to speed with the internet. We could see a decline in micro-trends and “wear-it-once” culture, making room for more thoughtful, lasting designs.

Our culture leans towards the romanticized idea of fashion - the runways shows, sales, dupes, internet trends but hidden behind all of that is the harsh labor that makes garments valuable in the first place. Working conditions in the garment industry have historically been dismal, even before the popularity of outsourcing - many of us learned about the Triangle Shirt Waist Factory Fire in grade school. As I grasp at straws to find the immediate potential benefits of tariffs, one may be the magnifying glass they’ll put on international garment production practices - whether they be intentional or collateral.

Given that a substantial portion of global cotton production originates from China's Xinjiang region—a source linked to forced labor involving the Uyghur population—these tariffs could indirectly address ethical concerns highlighted in Alyssa Hardy's Worn Out: How Our Clothes Cover Up Fashion's Sins. By increasing the cost of importing goods from China, the tariffs may encourage fashion brands to reevaluate their supply chains, potentially reducing reliance on materials produced under exploitative conditions. This of course will not solve these issues, but may provide an environment that challenges status quo. That is not to dismiss that if demand drops, factories may close and relocate to other outsourcing countries, potentially leaving Uyghur workers without any income or opportunities. With fewer jobs, Uyghurs might be more vulnerable to more exploitation in informal or illegal labor markets.

Clothing is a necessity. As much as someone like me may look at it as “Fashion” - focusing on materials, textures, designers, and culture, clothing is a necessity. If prices increase, people who need winter clothing still have a harder time accessing it. Will it become harder for brands to create inclusive clothing, with the excuse being the need to address a larger demographic

2 - Imitation Is No Longer Flattery or Feasible

With tariffs in play, "dupe culture" might take a hit. Brands like Fashion Nova, known for their quick-turnaround replicas of high-fashion designs, may find it harder to produce dupes at scale. When costs go up, knockoffs might not be as profitable, potentially paving the way for a creative renaissance. Struggles often breed innovation—perhaps the art and fashion worlds will thrive, with originality taking center stage.

From a trend perspective, the conservative business casual trend may be more than just a trend, as we explored in the Consumer Digest newsletter on J.Crew’s resurgence. Conservative clothing is more versatile than the fun, weekend wear we are used to seeing from fast fashion giants. Pretty Little Thing, knows this, hence their rebrand and last ditch effort to get in formation by looking more like Reformation.

As import costs increase prices for consumers follow suit, for normal people the goal is always to get that cost per wear down, especially for clothing. If an item only has one appropriate setting, and it’s not your birthday or wedding - you’re less likely to justify the splurge. If you can wear the dress on a date, or to work or to church you’ve achieved a diversified use value, making the item more feasible even if it costs more. The brand’s recent “legacy” relaunch didn’t just shed the overdone IG model aesthetic of "PLT"; it also came with a price adjustment. This could reflect improved materials—or perhaps a strategic move to get ahead of Trump’s promised tariffs, which are expected to drive up production costs.

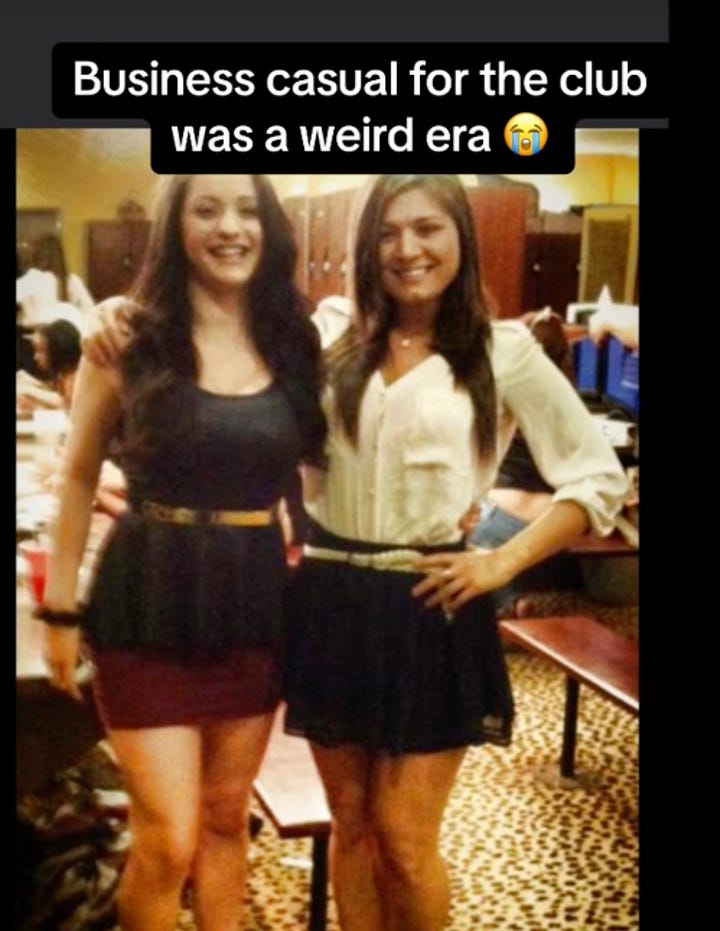

The Business Casual in the Club era for milenials perfectly exemplifies how shift in the economy influence fashion norms. This era ran in parallel to the Market Crisis’ of 2008 and 2012.

Millennials reacting to the trend.

3 - What Goes Around Comes Around: Secondhand Surge

I predict a rise in secondhand fashion. The consumption and production cycles for resale items differ greatly from new goods. With no need for raw materials or manufacturing, costs are primarily tied to shipping and inventory. Labor is often deemed the most expensive component of a business and rightfully so, it’s the most important. Labor is what makes something out if nothing. It transforms silk into pajamas, metal into buttons, threads into a stitch. In the secondhand market, however, variable capital—or wages—is largely limited to facilitating access to clothing, whether through retail work or tech labor for e-commerce platforms. It’s a more sustainable model, and with rising prices on new imports due to tariffs, thrifting and vintage shopping could shift from niche to norm.

On the same line of thought, I think many of us will shift from having sales associates on speed dial to having tailors and cobblers on standby.

The resale market is expected to reach $77 billion by 2028, outpacing traditional retail by 5x.

Rising costs for new imports could push even more consumers into the arms of vintage, refurbishing and resale.

4 - We’re Dropping “Drop” Culture

“Drop” culture, characterized by limited-edition releases and hyped launches, might also see a slowdown. As overseas production costs rise, brands may struggle to justify the expenses of short-run, high-risk collections. We could see a shift back to traditional seasonal releases rather than today’s unpredictable, monthly drops. The overhead for limited runs might simply be too high. Aside from consistent drops this could make it harder to start a line, especially for influencers or brands creating merch.

Our culture is obsessed with objects of affiliation, Erewhon Hats, Solidcore hoodies, the Rhode phone case - these types of items are typically outsourced, if it costs more to get those products it may be trickier to start a line.

A standard overseas manufacturing run has a minimum order quantity (MOQ) ranging from 500 to 1,000 units per style. When tariffs increase production costs, those small-batch runs become a luxury few brands can afford.

Is it Time to Drop Drops? How Drop Culture Creates Digital Tribes

On this weeks version of how “All Extremities Lead to Consumerism” we’re weaving together the key themes about modern consumer culture and community.

5 - The Return of True “Sample Sales”

Keep reading with a 7-day free trial

Subscribe to Consumer Digest to keep reading this post and get 7 days of free access to the full post archives.